Budgeting is one of the most powerful tools for achieving financial freedom, saving for retirement, and reducing money stress. Many people, especially over 50, realize the importance of planning their finances but struggle to make a budget that actually works. The good news? With a few practical steps, anyone can take control of their money and create a budget that’s realistic and sustainable.

Why Budgeting Matters

Budgeting is not about restriction—it’s about choice and control. A clear budget helps you:

- Track where your money goes

- Identify unnecessary expenses

- Save for retirement or big goals

- Reduce stress and anxiety about finances

- Build financial security and independence

Without a budget, even a comfortable income can feel tight.

Step 1: Track Your Spending

Before you create a budget, know where your money goes.

- Review bank statements, credit card bills, and receipts

- Categorize spending: housing, food, transportation, entertainment, and savings

- Identify patterns and areas for improvement

💡 Tip: Use budgeting apps like YNAB – You Need a Budget or EveryDollar to make tracking easier.

Step 2: Set Financial Goals

A budget works best when tied to clear goals.

- Short-term: pay off debt, save for a vacation

- Medium-term: build an emergency fund, invest in a side hustle

- Long-term: retirement, college funds for grandchildren

Knowing your goals makes it easier to prioritize spending.

Step 3: Create a Realistic Budget

Use the 50/30/20 rule as a guideline:

- 50% for needs (housing, utilities, groceries)

- 30% for wants (dining out, hobbies, travel)

- 20% for savings and debt repayment

Adjust percentages based on your situation. The key is realism—don’t cut out all fun or lifestyle flexibility.

Step 4: Reduce Expenses

Look for ways to save without sacrificing quality of life.

- Switch to generic brands for groceries

- Cancel unused subscriptions

- Shop smart during sales or use cashback apps

💡 Amazon Pick: Money-Saving Meal Planner – Helps plan meals and cut grocery waste.

Step 5: Build an Emergency Fund

Unexpected expenses happen. A dedicated fund prevents debt accumulation.

- Aim for 3–6 months of living expenses

- Keep it in a high-yield savings account for easy access

💡 Amazon Pick: High-Yield Savings Account Guidebook – Learn strategies to grow your emergency fund faster.

Step 6: Pay Off Debt Strategically

Debt can derail your budget and limit financial freedom.

- Focus on high-interest debt first (credit cards, payday loans)

- Consider the debt snowball method for motivation

- Avoid accumulating new debt whenever possible

💡 Amazon Pick: The Total Money Makeover – A step-by-step plan to eliminate debt and gain financial control.

Step 7: Automate Savings

Make saving effortless by automating transfers to savings or retirement accounts.

- Treat savings like a fixed expense

- Reduce temptation to spend extra money

- Use apps or bank features to automate deposits

💡 Amazon Pick: Automatic Savings Tracker Journal – Keeps you accountable for automated savings goals.

Step 8: Review and Adjust Regularly

A budget isn’t set-it-and-forget-it.

- Review monthly to see if spending aligns with goals

- Adjust for life changes: new expenses, salary changes, or retirement plans

- Celebrate milestones to stay motivated

Step 9: Include Fun in Your Budget

Budgeting shouldn’t feel like punishment.

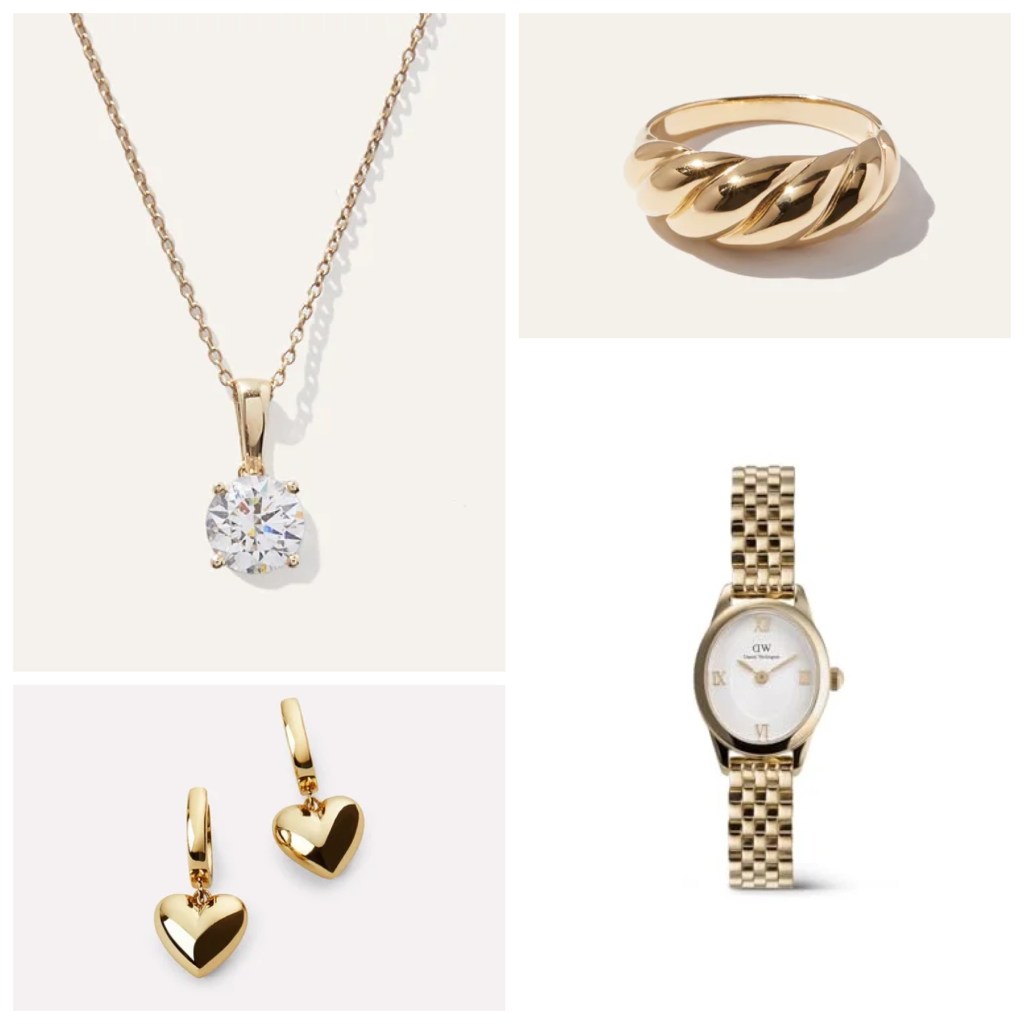

- Allocate money for hobbies, dining out, or small luxuries

- Helps you stick to the plan long-term

- Makes financial freedom feel rewarding

Final Thoughts

Budgeting is the cornerstone of financial security, independence, and stress-free living. By tracking your spending, setting goals, reducing debt, and planning for emergencies, you can create a sustainable plan that fits your lifestyle.

Remember: it’s not about restriction—it’s about choice. When you control your money, your money no longer controls you.